Contents

Profit is what keeps your firm running for the long term.

According to the AIA Firm Survey Report 2020, firm profitability as a share of net billings decreased 1.3% from 2017.

While this is a slight decline and most architecture firms still remain prosperous, there are always ways we can increase our profitability.

In fact, 53% of firms view increasing firm profitability as one of their top financial concerns according to Deltek Clarity Architecture and Engineering Industry Study.

So if you’re one of the 53% that want to increase your profitability, this article is for you. We’ll walk through the 7 steps you can do right now to make your architecture firm profitable.

1 – Work on the Business instead of in the Business

As architects, we love to focus on designing our projects, and we were never taught how to run a business.

The creativity of design might be what got you into architecture in the first place, but if you want to have your own architectural practice, you’ll inevitably need to learn how to run a business.

"The biggest challenge we have as architects is that we don’t come out of school understanding that to start a practice is to start a small business. Many of us don’t look at it that way...If you build a successful business, you can do a lot more of the things that you became an architect to be. You can spend more time on design. You can spend more time on solving problems. You can spend more time building a great relationship with your client and your customers.”

- Mark LePage, AIA from Entearchitect on How To Build A Successful Architecture Firm

Hire Experts to Fill the Gap

Mark also noted that makes a successful firm is the ability to find team members who can bring the necessary expertise to the table.

“Whether you like the business side or you don't like the business side, you should find somebody who is a compliment to you, somebody who’s filling in the gaps that you have and you fill the gaps that they have.”

- Mark LePage, Entearchitect on How To Build A Successful Architecture Firm

A lot of successful firms out there also employ the same strategy when it comes to finding the right person to take care of their businesses.

As part of their business management strategy, Ingels brought in Sheela Maini Søgaard as the CFO in 2008 and soon promoted her to become BIG’s CEO.

Jerry Garcia, Principal from Olson Kundig said that hiring a CEO has allowed their architects to spend less time on the business side and focus more on design.

“It's a lot of stuff to have to manage. And so it's nice, at least for me, from a personal standpoint, to not have to hawk the contracts as much as I used to in the past and have to be as responsible for that as I was in the past as a practitioner. So from that standpoint, there's just a lot going on in this office. And we need as much help as possible to be able to focus on the architecture.”

- Jerry Garcia, Principal from Olson Kundig on How to Foster Design Culture in the Firm

2 – Get Your Finances Under Control

Now that you have your mindset in the right place, it's time to work on your finances. Good financial management is key to a profitable firm.

The average amount of business loans/debt carried by firms in 2019 was $70,000 (AIA Firm Survey 2020). That’s enough to hire a new talent to help you with your billable work.

Rena M. Klein, FAIA of Charrette Venture Group, talked about all the basics you need to know for Financial Management as a Small Firms at Section Cut 2020.

As noted by Rena in her workshop, having a good understanding of financial management can help you:

- Tracks firmwide short-term performance and long-term trends

- Provides insights into changes in business outlook

- Provides insights into operational effectiveness

- Provides insights into how to improve profitability

- Facilitates smart business decision-making

Another great place to start learning about financial management for architects is our Guide to Financial Management for Architecture Firms.

In that guide, you will learn all you need to know about financial management and more on why it's so important.

3 – Run Projects On Time

No one likes to see projects running behind schedule. Not only does it cost a lot of headaches, but it can also cost you a lot of money.

The Deltek study defines a High Performer as firms with a net labor multiplier of 3.0 or higher and an operating profit on net revenue of 15% or higher.

Only 21% of the 480 companies that took part in the study were considered “High Performing Firms.”

One of the top activities these high-performing firms are doing is focusing on being on or ahead of schedule for their projects.

There is a 10% difference between high performers and all the rest on the numbers of on-time or ahead-of-scheduled projects.

This is why using a project management software like Monograph is important. You can plan your project schedule and budget in an easy-to-use Project Planner and visualize your timeline on the MoneyGantt.

If you want to start running profitable projects that are on time and on budget, book a demo with Monograph today.

4 – Make Data Visible with Practice Operations Software

Raw data can be hard to visualize. Excel spreadsheets or complicated accounting software hides a lot of valuable data.

Part of our mission at Monograph is to increase your profitability. To do this we need to bring more of your financial data out into the light.

Our Planned Profit Report shows you your profits month-by-month on an easy to understand dashboard.

With your Planned Profit Report, you can:

- Visually see your planned profits from the past to the future

- Understand your firm's overall financial health

- Make data-driven financial decisions

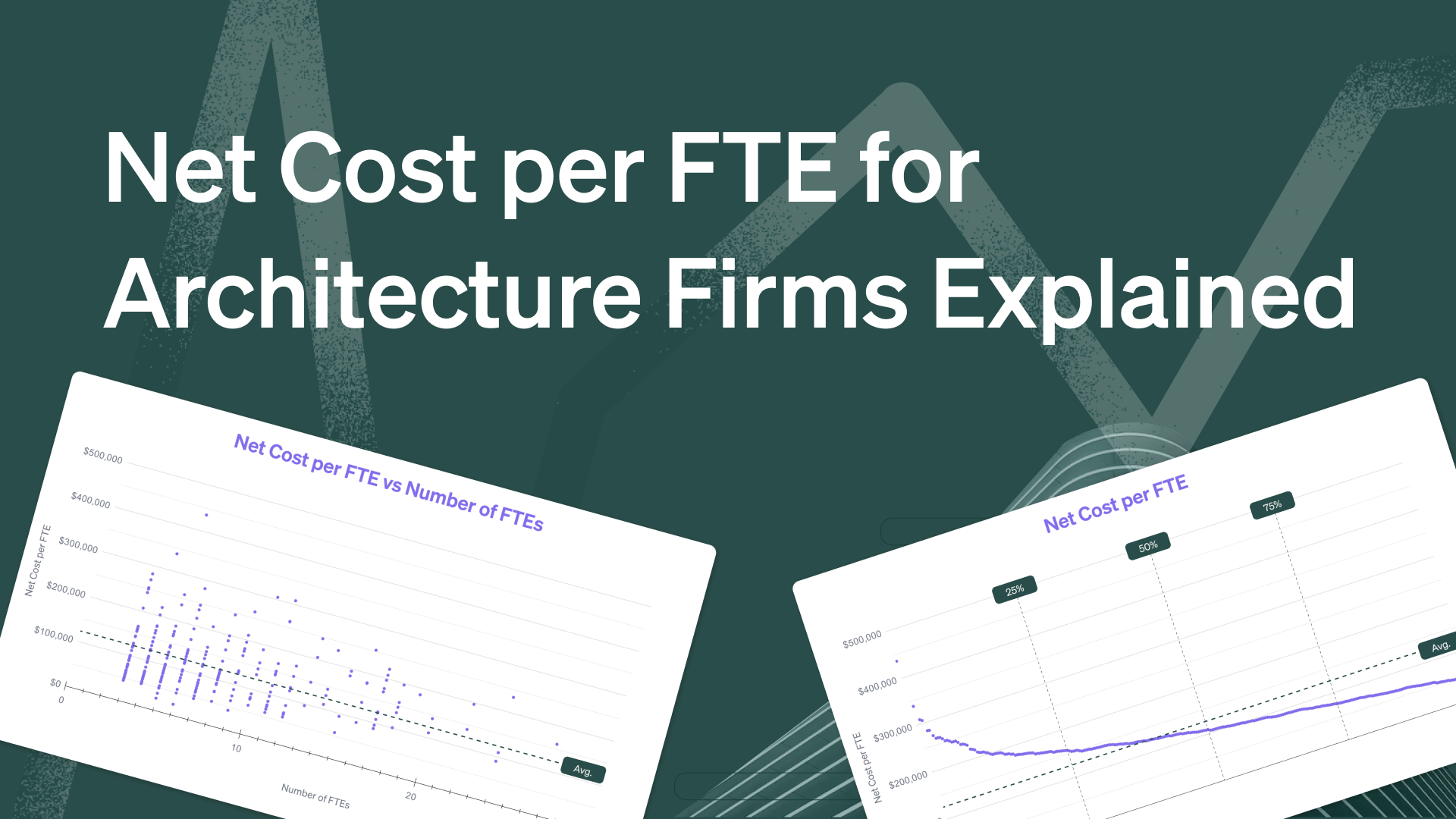

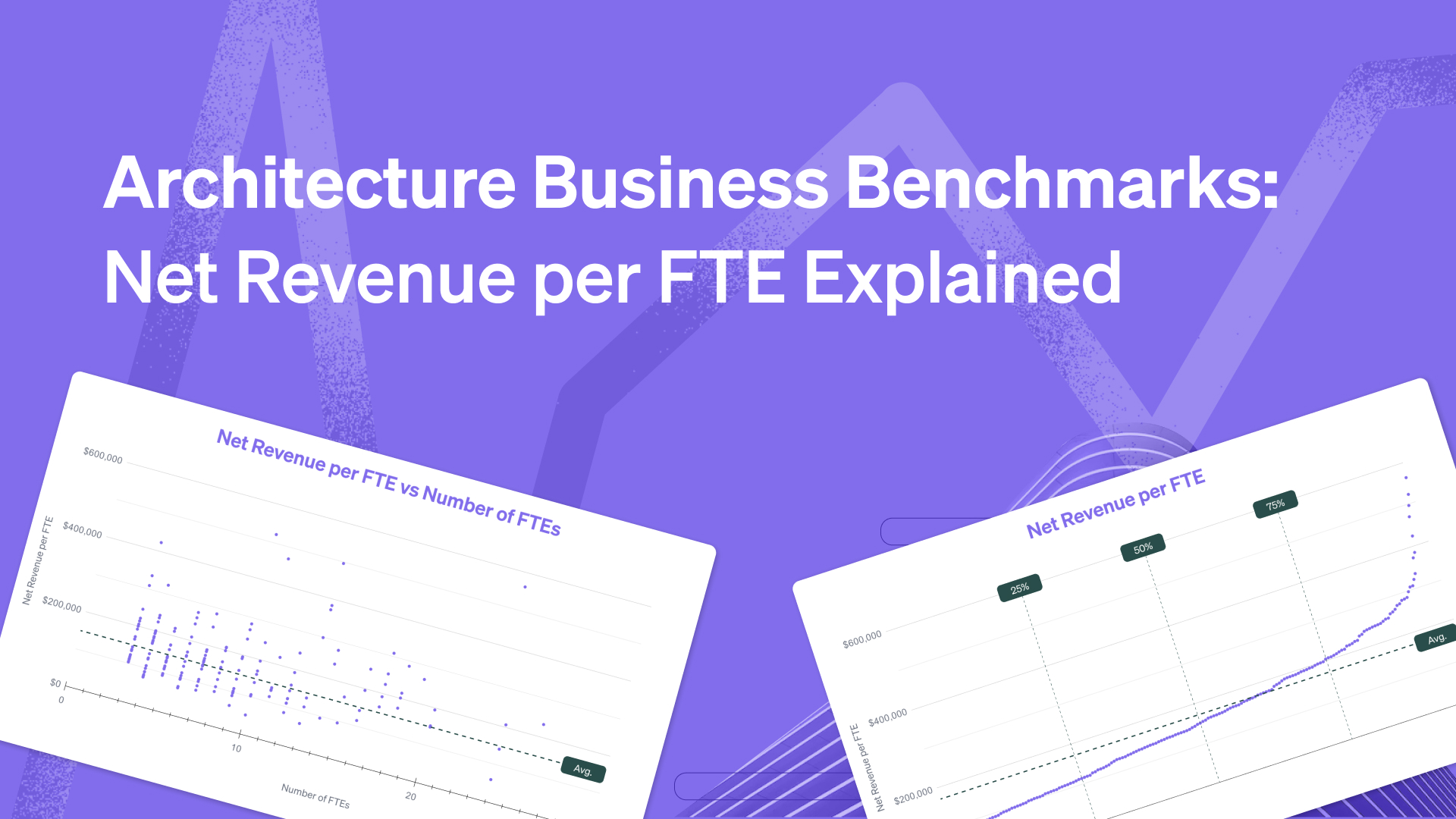

5 – Monitor Your KPIs

Key Financial Performance Indicators (KPIs) are metrics for measuring the strategic financial and operational success of your firm. They are often used to compare firms within the same sector.

Monitoring KPIs is a significant factor in your firm's performance.

As an architecture firm, you should set your own KPIs. Aim for around 5-7.

You want to measure KPIs that have the most impact on your path towards success.

Some standard KPIs you might want to consider as an architecture firm include:

- Operating Profit on Net Revenue

- Net Labor Multiplier

- Total Payroll Multiplier

- Overhead Rate

- Break-Even Rate

- Pending Proposals

- Backlog Value

Learn more about KPIs in this article on the 10 Key Financial Performance Indicators for Architecture Firms.

6 – Understand What’s Driving Your Profit

According to the AIA Firm Survey Report, 70% of firm billings are derived from repeating clients.

How do we identify which client is worth repeating?

We might all have a favorite client to have a drink with, but they might not always be the client that makes us the most profits.

That's why we created Profit Drivers.

Now you can use crowd-based software like Monograph to visualize what actually makes you the most money in your firm.

Our Profit Drivers allow you to break down your profit based on project types, people, clients and phases.

According to the AIA Firm Survey 2020, architecture firms with a commercial/industrial specialization reported the highest profitability at 14.8%.

If you don't know what project type is making you the highest profitability, you can now see the actual data to double down on that specialty within Monograph.

7 – Provide Additional Services to Boost Profit Margin

While basic design services are increasing as the top source of gross billings in architecture firms, you can still expand to other additional services to increase your profit.

An obvious additional service is planning and pre-design services, which in 2019 took up 9% of the gross billings in firms.

Pre-design services can include:

- Code analysis

- Master planning

- Programming

- Property valuation

- Site planning/selection

- Urban design

This is common practice when working with developers before the start of a project. Architects are usually hired to do feasibility studies to see if a site is feasible for the building type and program required by the client.

Alexandra Militano from Alloy Development talks about how they, as a developer, work with architects in feasibility studies.

“Our architects actually do come into play with that (the feasibility phase) rather than just being like, ‘we're allowed to build a three-story building here.’ Our architects will actually do some quick sketches on it and give it a little more taste of what's around that neighborhood.”

- Alexandra Militano, Director of Construction from Alloy Development on How to Build as an Architect-led Developer in NYC

Our services don’t have to stop when the building is built. While not a lot of architecture firms are providing operations and maintenance services, it could be a very profitable area that we could expand into.

With all BIM models that we build to create construction documents, we can use the same models to help clients continue to monitor, operate and maintain their buildings.

Better yet, you could charge a monthly retainer to consult on improving their building performance so you can have recurring revenue going forward.

Some operations and maintenance services can include:

- Commissioning

- Energy monitoring

- Post-occupancy evaluation

“I would like to see us expanding into more areas. I would like architecture firms figuring out what other SaaS models that they can deliver to their clients to continue a relationship after a building is built, helping them operate and maintain buildings.”

- Evelyn Lee, FAIA from Slack & Practice of Architecture on How To Empower Your Team Beyond Projects

Build a Profitable Firm that Lasts

By taking action on these 7 steps, I hope you can start to see improvement in your architecture firm's finances.

Which one of these steps would you take to increase profit in your firm?

Do you have any suggestions on how to drive values for other firms?

Either way, let me know your thoughts in the comments section below.

And if you want to make better decisions to increase your profitability, get started with Monograph today.